We all know the probability of a startup becoming a Unicorn or having an amazing exit is quite low. Well below 0.1% actually. When the startup manages to get seed money, the probability increases, but only to about 1%. This essentially means that there are not that many good companies to invest in, or that it’s really hard to select which ones to invest in.

As new to the game, you need to understand a few basic facts and that’s what this article will guide you through. First, some of the best deals will only be presented to a few selected and respected individuals and funds. It is not likely that the best deals will arrive at your desk out of the blue, so you need to work your way up. The essential economics and structure of the market usually work against angel investors, meaning that you may be better off investing in funds or allocating resources in a different way. But there is no fun in that, is there?

So why would you want to become an Angel investor? There are many reasons out there, but think that a good one-off investment may prove incredibly successful and you don’t necessarily need a unicorn exit to make very good money. You will also likely enjoy the process and be hungry for more. With a proven process and (a bit of) luck, you may be able to succeed as many do.

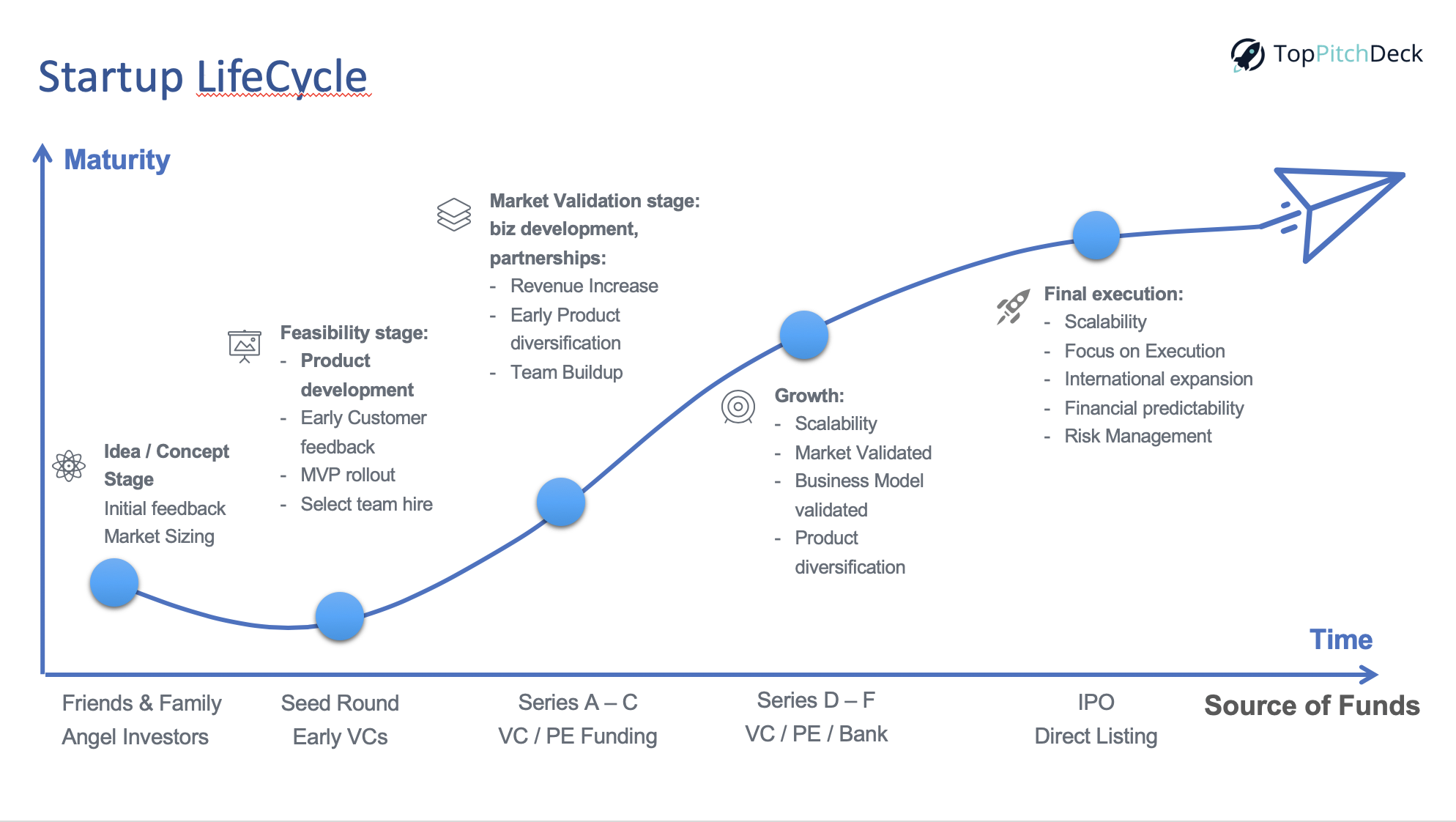

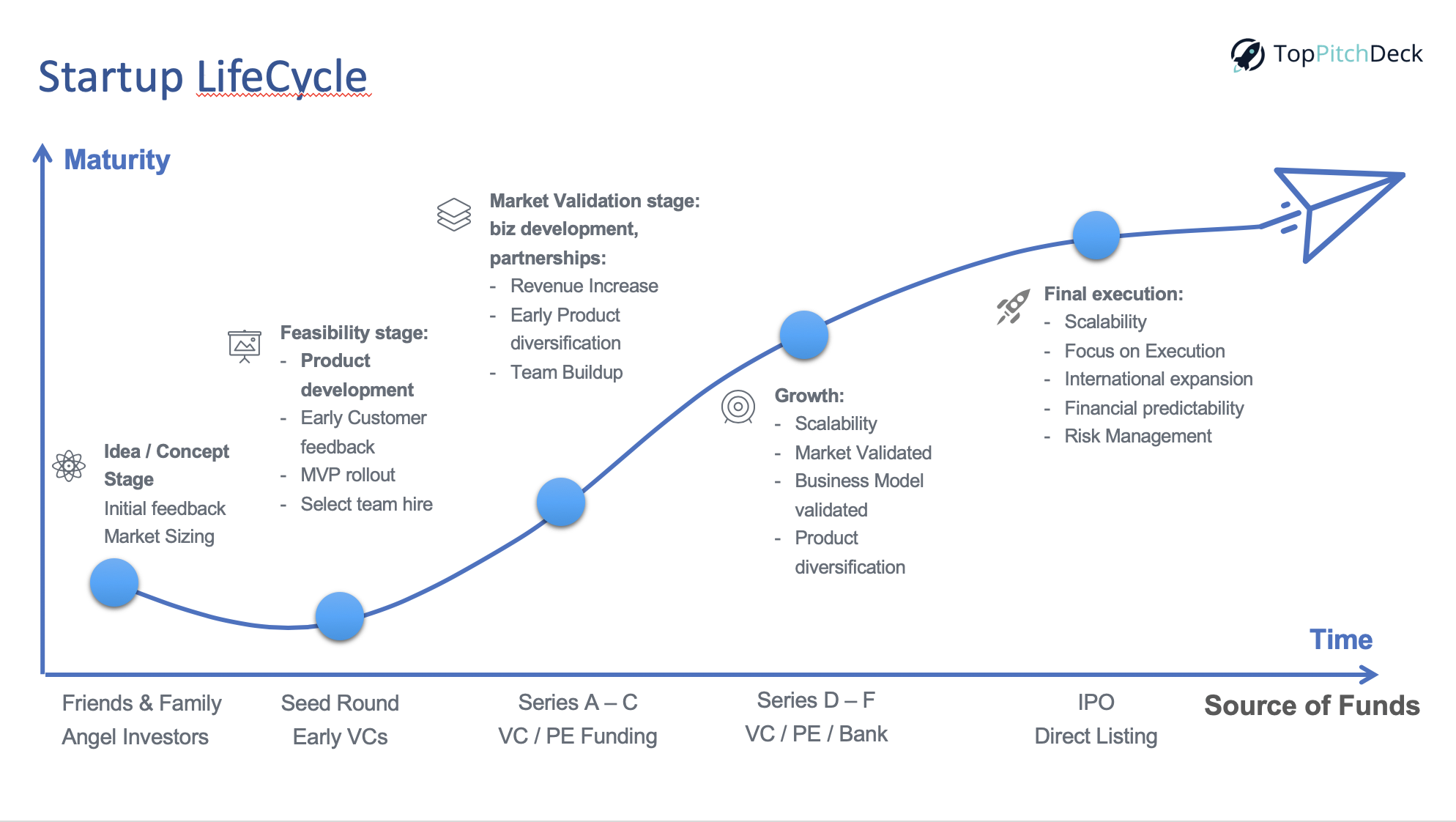

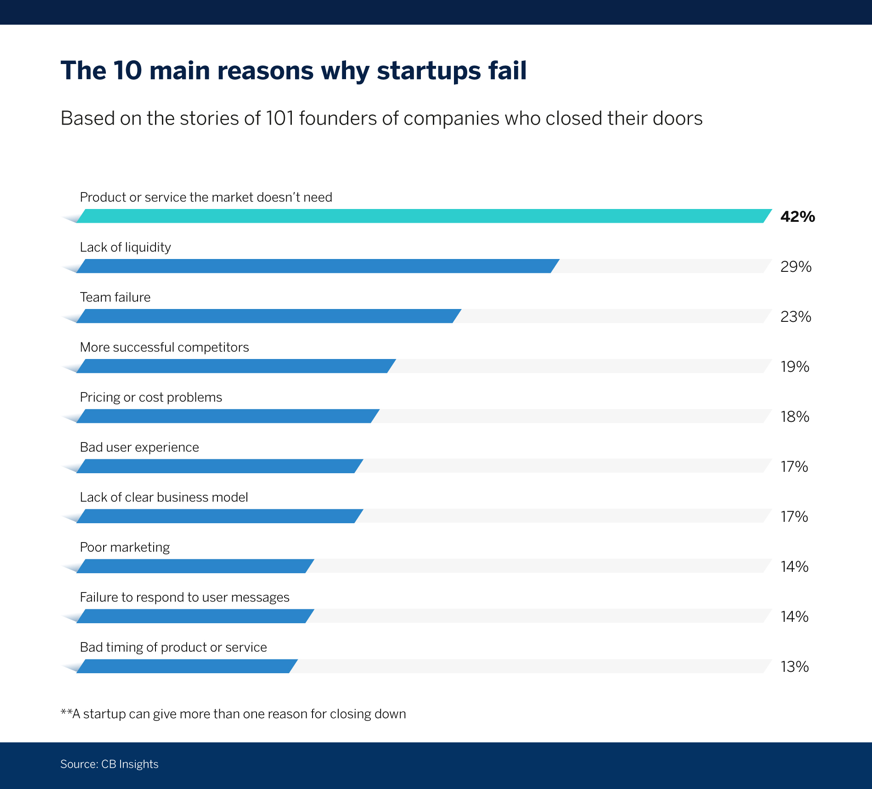

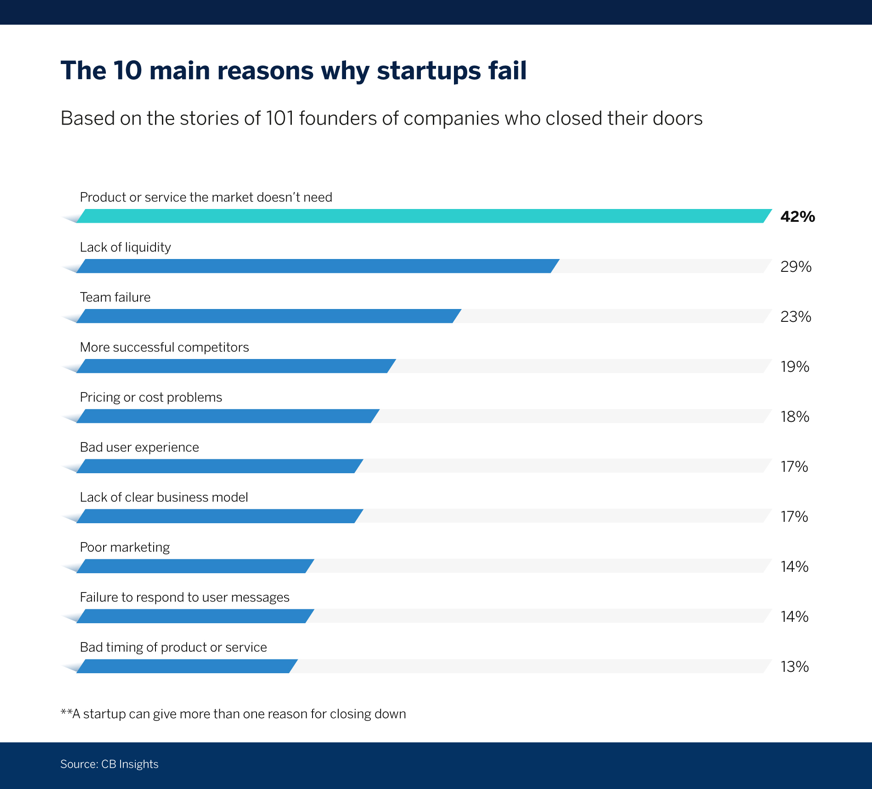

To become a successful Angel you need to focus on several things such as understanding the startup market and the nature of founders, and why the market is set up in a way that most will fail. You also need to focus on what are the main reasons for investing in a specific startup and the key points that need to coexist in any presentation or deck. But above all, the main thing you need to pay attention to is the avoidance of failures and how to specifically manage them… because there will be some. As obvious as it sounds, therein lies the key to success. Probably the most important thing about investing in startups is understanding why more than 99% of startups fail. There are a vast number of statistics about startup failure, but in a nutshell, most fail for one (or more) of the following reasons: no market needed, team failure, too much competition, and lack of cash or funding.

How to manage this information and avoid ‘bad’ deals will be fundamental to your success.

Since you have decided to become an Angel Investor, there are a few questions you need to ask yourself and the Founders of any startup you may be considering. We will group them into four categories, which, according to our experience, are the most important aspects to consider. These are: the Market, the Product, the Team, and the deal.

The Market

Without getting into specific data, we all know there are tons of new startups emerging every year. The numbers are growing exponentially with technology advances and with newer generations looking to replicate the success of others rather than starting their careers in mainstream jobs. So it is clear that many will fail to secure funding and many more will fail along the way.

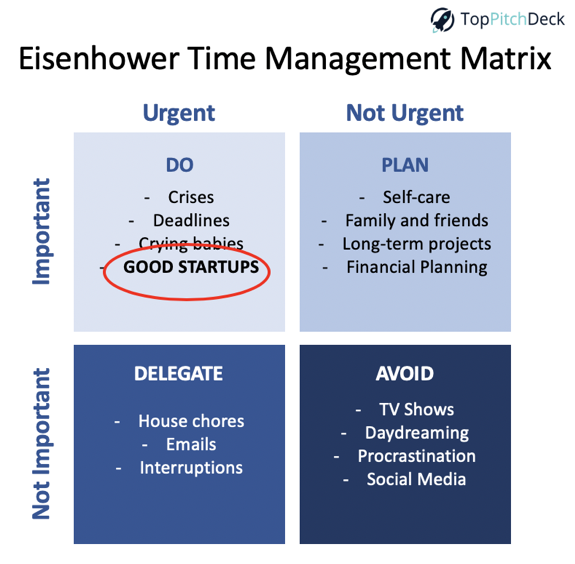

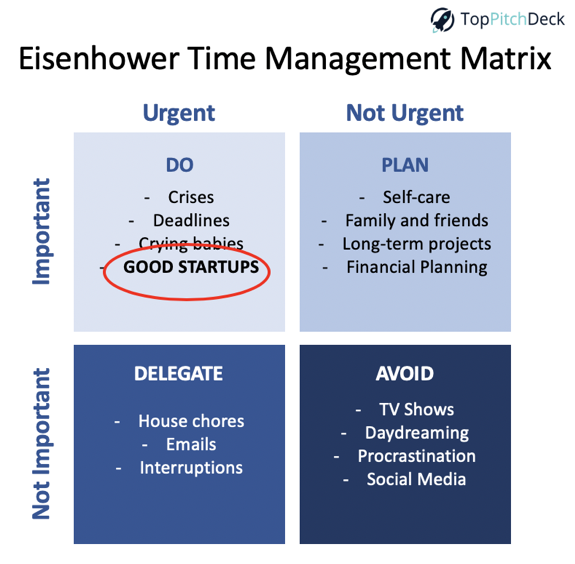

The main reason for a startup to emerge is that there is a specific problem that its Founders deem necessary to solve. So our first step for considering any deal is how real, urgent or painful is the problem they are trying to solve? This is foremost the first and most important question. If the problem does not appear urgent or important enough for you, then clearly you should not invest.

After you have established there is a big enough and urgent enough problem, think about where the problem exists and if there will be a market or people willing to pay for a solution. Maybe Founders approach you with a great problem (and solution) where they believe they will hold 100% market share. But if the market is tiny, 100% market share of zero is still zero.

Additionally, you need to understand that the market may not exist today but will exist in the future. Think of Steve Jobs and the iPod, iPad, iPhone, etc. He created gadgets and built their subsequent markets. Some markets inevitably will be redefined by new companies and startups, so a bit of futurology will be required of bold Angel Investors. Think of Google, Facebook, Amazon, Instagram, Uber, Tesla, Spotify, Airbnb, etc., etc., etc. Somewhat a leap of faith. But relax… you do not need to fix yourself in finding the next Google or Airbnb.

Once you believe that the market is (or will be) big enough, you need to assess if the timing is right for the investment and for the solution. Does the market need the amazing solution NOW? If it’s an old solution or a rerun of something that existed in the past, you need to understand why something failed back then. It may well be a completely different market today and timing may be right now. Understanding the reasons is all that matters. But if the timing is wrong, or the reasons why something failed in the past have not changed, then the startup will inevitably fail.

The Product

Next we believe the second pillar of the decision making process points to the startup and the product itself.

After you have analysed the problem and the market, do you think that the solution being proposed by the startup will succeed in the market? Will it be adopted? Are there any significant impediments? What stage is the solution at?

These are some of the questions relating to the solution of the problem. The Founders’ answer to these questions should help you make a decision.

But answers alone should not be enough since Founders tend to lie and exaggerate their progress and potential. Query if there is an MVP (minimum viable product) or a working prototype. If there isn’t one, you should rethink your investment, as most startups will aim to have some working solution, even if not scaled, to attract funding. We are all full of ideas, but the execution of a working MVP at this stage is fundamental.

You should also enquire or research about competition and if the solution is easily replicable or not. Their solution should be multiple times better than comparable or existing competitors and relatively hard to copy (regardless of whether a patent exists or whether Founders promise you it’s impossible to replicate). It’s not enough that a small percentage of clients prefer the startup’s product… it should destroy what existing solutions do, even if at a slightly higher cost. Cost or price at this stage should not be a concern, as you are not trying to fund a startup who will do the same thing others are doing but cheaper. You should be looking for a much, much better solution than existing ones.

Finally, one should look at metrics such as LTV (lifetime value), CAC (customer acquisition cost), cashflows, payback cycle, scalability, and their business model in general. Remember that forecasts and growth and revenue projections are usually complete fabrications, so look at them carefully and test their assumptions rather than their final projections. The unit economics will tell you a much more granular story of the product and will eventually allow you to make your own, simple, models.

The Founders and their team

For some, the Founders (and potentially their team) is the most important aspect of any startup, allocating up to 80% of their decision on the team. The market may be small, the product imperfect, the competition high, but some think that if the team is great, then all else can be worked around. The team is a fundamental part of the startup, however you should not lose focus of the other considerations. But you need to love (and be nice to) the team as you will be working with them.

But it’s true that a great team will be able to deal quickly with changing environments, complications and disasters. Many things can go wrong in the early stages of a startup and, even though teams anticipate many issues, there will inevitably be problems and roadblocks along the way. Age usually will play its part and statistics show that Founders are in their mid/late forties (with good experience under their belts) will produce better results.

Moreover, team harmony, how they met, why they stuck together, do they share the same goals, are the roles well defined, etc. are some of the important subjective parameters that will show up when things get tough. This assumes a team of more than one, of course, as it is proven that teams of 2 or 3 will deliver better results than individual Founders. And they need to be focused and able to execute. A great idea without execution is worthless, same as a Founder doing 3 jobs at the same time or someone who can’t hire a great team.

Finally, the team should also be open to feedback (you should be able to test this easily) and, to a degree, coachable and adaptable. A team who cannot take constructive feedback or that does not accept help and coaching will rarely do well with clients, customers or in the next funding round.

The Deals

First and foremost, remember this is an investment decision. If you are personal friends with the Founders, you still need to treat this as an un-emotional investment. Otherwise you risk making mistakes. It is key to treat this as any other investment decision, so do use whatever investment decision process you use on your other investments.

The main difference with other investment is perhaps that the survival and success rates of startups is very low. There is a very high degree of risk and uncertainty, usually accompanied with high potential rewards. With the uncertainty come low valuations, which hopefully should increase as the startup develops its product or scales its sales. Seeing the valuation grow in subsequent funding rounds gives a massive adrenaline boost, which adds to the financial rewards.

That being said, always bear in mind that Founders don’t have all the answers and therefore it is important that you always do your own extensive research. Although you need to trust the Founders, their point of view will always be skewed towards success. As a potential investor, your objective view and research will either confirm or reject the data shown to you and will help you make a decision. It shouldn’t be that difficult to test the size of the market, its future, previous failures, sales potential, alternative products, competition, timing, replicability, etc. Think about what needs to go right for the startup’s product to work and “sell”.

Regarding the amounts to be invested, this varies vastly from investor to investor. Startups usually run out of money before they think they will, and they will take double the time they forecast. So there is no real insight in this regard. You do need to think about what they need the money for and when do they need it. Can they continue without your money? Ideally you should invest when your money will be key for them to move forward.

When looking at the percentage of the startup that you should require, there is no need to take a huge stake. Most Angel Investors are within the region of 10% to 30%, with 15% being a good place to be. It does not pay to get stuck with valuation arguments, as any good exit would make a small difference compared to the initial valuation. Moreover, if you own a massive percentage, it will be very hard for subsequent rounds of funding to be attractive.

And note that Founders don’t like milestone based funding. It restricts them and they are very complicated to calculate and enforce. Things always change, so do milestones and metrics, and not necessarily for the worse. It is much better, in our opinion, to keep terms simple. Remember you will be one of the last investors to be paid, just before the Founders and employees, so any restrictions or preferences will be required by any funding round investors too, making deals much more complex.

Summary

If you are to take away just a few things from this short article, be smart and take a calculated risk. Try to focus on industries you know about and build yourself a niche or brand, so as to attract other deals in the business. Potential rewards are high, but know there will always be another deal soon and that FOMO is not a valid reason to invest. If you have done your research and love the team, understand the problem and the solution, and believe in their execution capabilities, help them get to that precious next stage of funding and see their valuation multiply.